Husband-Wife Fraudster Chiropractors Lose Licenses

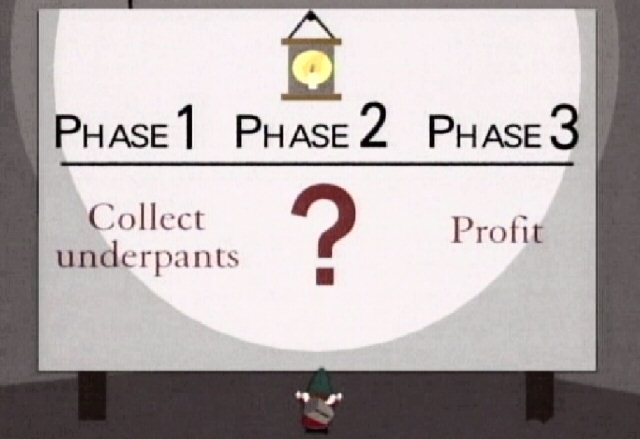

The Court of Appeal recently affirmed the findings of the Board of Chiropractic Examiners and its decision revoking a chiropractor’s license. Sit back dear readers, and read of a scheme that reminds your humble blogger of that of the underpants gnomes.

It appears that Aster Kifle-Thompson, was employed at chiropractic clinics owned by her chiropractor husband Steven Thompson. Steve was convicted of seven misdemeanor violations of Insurance Code section 1871.4 in 1997 and his license was revoked in 2000. (For those curious amongst us, section 1871.4 deals with submitting fraudulent workers’ compensation bills.)

Steve and his wife Aster then set up a series of shell corporations managing and owning several clinics, and then submitted fraudulent and excessive workers’ compensation claims for payment. The scheme involved having an out-of-state physician, an M.D., who was licensed in California act as the “owner” of the corporation, while the services were actually provided by Kifle-Thompson and her husband.

The Board of Chiropractic Examiners found that Aster had committed several of the 35 alleged violations of section 317 of Title 16 of the California Code of Regulations (unprofessional conduct), citing the subsections mostly addressing dishonesty.

After the Board of Chiropractic Examiners found Kifle-Thompson had committed several of the 35 alleged instances of unprofessional conduct, and revoked her license. The trial court, and in an unpublished opinion, the Court of Appeal, rejected Kifle-Thompson’s appeals.

So let it be known – the business model of:

Step one: get licensed

Step two: lose license by committing acts of dishonesty and workers’ compensation fraud

Step three: profit

Does not work! It didn’t work for the underpants gnomes either!

Did you have to deal with the bills of Steve and Aster? If any bills are still pending, you may want to take a look before paying them off.