There are very few flames of conflict that burn as hot as those fueled by intra-family feuding. We can forgive those enemies we made at arm’s length just as we would forgive a bee for buzzing or a blogger for blogging, but when family members, however distant, cross swords, pretty it ain’t.

So it seems was the case in the matter of Yacoub v. Talia, a recent unpublished Court of Appeal decision.

This was a civil trial, but it bears some importance for all of us aboard the slowly sinking ship U.S.S. Comp.

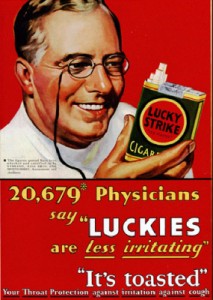

Yacoub sustained injury to his shoulder after falling from a ladder while pruning trees outside of Talia’s store. Talia’s cousin was Yacoub’s wife, and Yacoub had done some odd jobs for Talia in the past, receiving payment in cigarettes, lottery tickets, and cash.

It appears that Yacoub and Talia has a serious falling out, with Talia telling Yacoub never to return to his store, well before this injury. Yacoub, on the other hand, claimed that he was an employee and that Talia should have carried workers’ compensation insurance which would have covered Yacoub’s tree-trimming activities.

After hearing testimony, the jury found for Talia, and that Yacoub was an independent contractor rather than an employee.

Now here comes the kicker: Yacoub appealed, arguing that he was entitled to a jury instruction that one person rendering service to another is presumed to be an employee.

The court of appeal was not sympathetic to Mr. Yacoub’s argument, however, noting that a party is only entitled to jury instructions which are legally correct, and that Labor Code section 3357 provides that any person rendering service for another, other than an independent contractor, is presumed to be an employee.

Mr. Yacoub also argued that, under Labor Code section 2750.5, as he was doing work which required a license and he didn’t have a license, he was conclusively presumed to be an employee and thus entitled to be considered an employee.

The Court of Appeal likewise rejected this argument, reasoning that section Business and Professions Code section 7048 requires at least a $500 contract price in order to trigger the licensing requirement, but there was no proof that there was contract price over $500, and, in fact, the proof to the contrary established the price of the contract (if there was one) to be under $200.

Nor was the Court of Appeal persuaded by the argument that, as there was no contract in place, there was no contract price, making section 7048 inapplicable.

Mr. Yacoub’s final argument on appeal was the fact that the Mr. Talia used the fact that there were no W-2s filed, and there were no withholdings made, which further supported the finding that there was no employee relationship. His argument rested on “tax-payer privilege.” However, the Court of Appeal found that this so-called privilege only applied to the compelled disclosure of financial information, rather than the lack of existence of these documents. The payment or non-payment of taxes, rather than the specific finances involved, are fair game.

So, why is your humble blogger wasting your time with non-citeable appeals decisions from civil cases? Because, dear readers, this serves as a friendly reminder about what happens when an independent contractor gets hurt on the job.

Remember, after all, how quickly things change. The man who claims the title of entrepreneur, the same one who defiantly shrugs off the yoke of employment, the one who risks the famines to reap the feasts, quickly changes to a scared, abused victim when he gets hurt on the job and can blame his former client.

So, when an independent contractor gets hurt, he or she will fight tooth and nail to be judicial found an employee rather than an IC. And if that claim succeeds, then the added pressure of the Uninsured Employer Benefit Trust Fund and its bag of tricks comes into play to force a larger settlement.

This entrepreneur, while defiantly shrugging off the yoke of employment, wishes you a good weekend!