Happy Monday, dear readers!

A while back, your humble blogger reported on the Berrios v. EJ Distribution Corporation. In that case, the employer had obtained insurance coverage with the understanding that its employee truck drivers do not operate outside of California. Of course, applicant sustained injury while operating outside of California, and the insurance company sought to rescind coverage and avoid liability for the claim.

The arbitrator found that the insurance company could NOT retroactively rescind coverage, but could only cancel coverage going forward and sue for damages. The WCAB affirmed, so the matter went before the Court of Appeal.

Well, the Court of Appeal issued its unpublished ruling recently, and, due to the Herculean efforts of counsel for the insurance company, obtained a remand.

The question in this case is and always was – what happens when an insurance company alleges that a policy was obtained by false statements by the employer, and an injury occurs under said policy? The insurance company, of course, wants to rescind the policy, refund the premiums, and be no its way. The employer, fearful of being left in the cold, wants to let the insurance company pay for everything and then spin its wheels coming after the employer.

The Court of Appeal’s opinion cited Insurance Code 650 and Civil Code section 1692 for the proposition that the policy could be rescinded.

However, the Court of Appeal also held that the insurance company missed a vital step in the rescission process. While the first step appeared to be completed correctly, that is, notifying the insured of the rescission and returning or offering to return the premiums, there is a second step:

“[t]he thought that performing the acts set forth in Civil Code section 1961 effectively discharged [the insurer’s] obligations under the contract is incorrect. A judgment finding that [the insurer]’s rescission was effective following an action filed to enforce the rescission under Civil Code section 1692, on the other hand, would be the discharge that [the insurer] seeks.”

Ultimately, the Court of Appeal remanded this matter back to the trial level to consider rescission under these two code sections. While the original arbitrator ruled, and the WCAB affirmed, that the insurance company could not rescind its policy, the Court of Appeal disagreed and appears to rule that for the rescission to be complete, the insurance company has to take the issue to trial on the issue of whether the rescission was for a valid reason. (See California Civil Code section 1689).

So, now, the matter should be submitted to arbitration to determine, as a matter of fact, if the misrepresentations made in this case were material “determined not by the event, but solely by the probable and reasonable influence of the facts upon the party to whom the communication is due, in forming his estimate of the disadvantages of the proposed contract or in making his inquiries.” (Section 334, as cited by the Court).

In summarizing the facts, the Court of Appeal’s opinion makes reference to the insurer’s investigator discovering that prior to obtaining coverage, the employer was operating outside of California.

But let’s take a hypothetical case – what if the employer did NOT operate outside of California at the time of obtaining coverage, but started to do so due to a new business opportunity, but did not advise the insured? If the statements were true when they were made, and subsequent events made these statements “stale”, would rescission be as easy to effect defend?

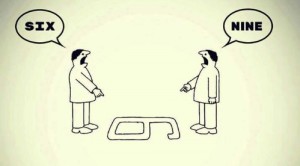

These issues come up often enough – the employer might say the number on the floor is a six, the insurer might see it as a nine, but when an employee trips on the number and files a claim, the last thing the employer wants is to discover it’s given an interest free loan in premiums to its insurer, and then have to address a claim.

This is an interesting case and I’m hoping to find out how it ends as the reasoning will be relied upon for subsequent matters, even if it can’t be cited.