Day After Thanksgiving Held NOT a Holiday

Happy Monday, dear readers!

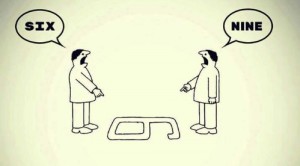

Pop quiz – is the day after Thanksgiving, what some marketers have started referring to as “black Friday” a business day? A holiday? A working day?

Yes, no, maybe, sometimes?

Depending on where you look, the day after Thanksgiving is or is not a holiday. The California Department of Human Resources has it listed as one, as does the California Rules of Court.

The Federal government does not recognize the day after Thanksgiving as a holiday, however. Government Code section 6700 likewise excludes the day after Thanksgiving from the Holiday list.

I know this seems silly, but it was the key question in the writ denied case of Gomez v. Department of Corrections.

The WCJ ruled that defendant’s UR determination was untimely because the day after Thanksgiving had been counted as a normal business day (rather than defendant’s position that this counted as a holiday).

Citing Labor Code section 4600.4, which defers determinations of holidays to California Civil Code section 7, the WCJ, and then the WCAB, determined that the day after Thanksgiving counted towards the 5-day UR determination requirement and was not a holiday.

Bear in mind, dear readers, that the State of California and all judicial employees, as raised by the defense in this case, get the day off as a holiday – but UR employees are expected to continue working, as per the reasoning drawn from this case.

From your humble blogger’s experience, most UR reports come in on the fifth working day, probably because most UR reports aren’t the only report the UR vendor is working on. If Thanksgiving Thursday is a holiday, but Thanksgiving Friday is NOT a holiday but will be observed in every workplace as a holiday, that means the UR reviewers must get everything that would be due on that Friday out the door that Wednesday.

Your humble blogger isn’t complaining about this result, mind you – we the brave and free citizens of California need only exercise our will to have Black Friday recognized as a holiday through the legislative process. But as this is the likely interpretation going forward, perhaps we in the defense community need to alert our beloved UR vendors that they will have to double time their reviews as Turkey Day approaches.

In the meantime, it appears that we should continue to be on the look-out what we might regard as holidays that are not actually state holidays. For example, I don’t expect to see the WCAB close its doors on the recently passed Pie Day (March 14th) or on Star Wars Day (May the 4th), which is coming up all too fast.

Good luck this week, dear readers!